Buying Property in an Undesirable Area

Investing in property is often seen as a pathway to financial stability, but the location is a critical factor that can make or break an investment. While prime postcodes command high prices and offer perceived security, so-called "undesirable" areas present a unique set of opportunities and risks. For savvy investors willing to look beyond initial perceptions, these neighbourhoods can offer significant financial upsides, provided the decision is made with thorough research and a clear understanding of the potential downsides. Evaluating both sides of the coin is essential before committing capital to a property in a less-than-perfect location.

The financial appeal of overlooked neighbourhoods

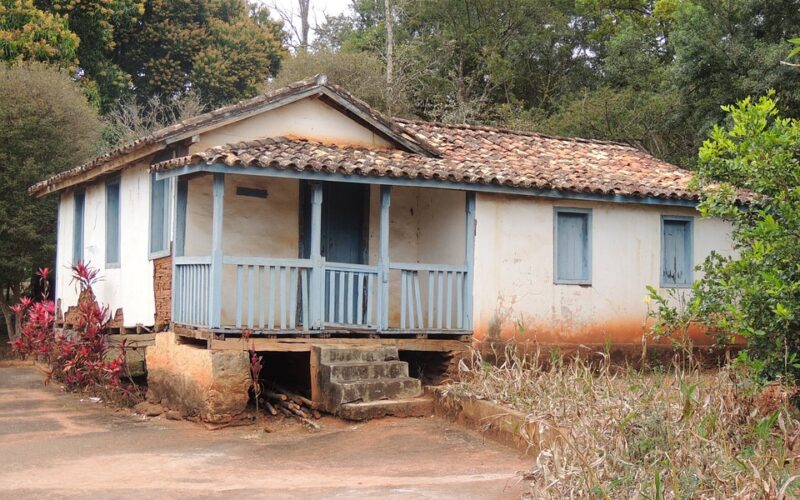

The most apparent advantage of buying in a less sought-after area is the lower entry price. Properties are significantly more affordable, which reduces the initial capital required and lowers mortgage payments. This affordability directly translates into a higher potential rental yield. Since rental income may not be proportionally lower than in prime areas, the return on investment can be substantially better. Furthermore, these properties often present value-add opportunities. An investor can purchase a rundown building, renovate it, and either increase its rental income or sell it for a profit, a strategy often unachievable in expensive areas where properties are already at their peak value.

Opportunities for growth and negotiation

Beyond the immediate numbers, investing in an up-and-coming area allows you to become part of its revitalisation. As more investors and homeowners move in and improve properties, the entire neighbourhood can transform, leading to significant capital appreciation over the long term. Early investors stand to benefit the most from this gentrification wave. Additionally, the market dynamics in these areas often give buyers more negotiation leverage. Sellers may be more motivated, and with less competition, you are in a stronger position to secure a favourable price and better terms, further enhancing the investment's potential profitability from day one.

Navigating the significant risks and challenges

However, the risks associated with these areas are substantial and must not be underestimated. Safety and crime rates are often primary concerns, impacting tenant attraction and retention. Property value appreciation can be slow or non-existent for years, tying up capital with little to no growth. Securing financing and insurance can also be a hurdle, as lenders and insurers may view the area as high-risk, leading to higher premiums or outright refusal of service. These factors contribute to the possibility of longer vacancy periods between tenants, which can quickly erode the high yields that made the investment attractive in the first place.

Mitigating risks through planning and security

Careful due diligence is the best tool to mitigate these challenges. This includes researching local crime statistics, speaking with residents, and understanding the council's plans for local development. A key part of this planning involves addressing security concerns head-on. For a residential property, installing a robust domestic CCTV system can act as a powerful deterrent and provide peace of mind for tenants. If the investment is a mixed-use or commercial building, a more comprehensive commercial CCTV setup may be necessary to protect the premises and its occupants. A well-implemented closed circuit TV network demonstrates a commitment to safety, making the property more appealing to potential renters and reducing security-related risks.

Beyond security, strategic property upgrades can attract better tenants and justify higher rent. Focusing on improvements that enhance safety, comfort, and aesthetics can make your property stand out. Engaging with the community by joining local business associations or neighbourhood watch groups can also provide valuable insights and foster a sense of shared ownership in the area's improvement. This proactive approach helps protect your investment while contributing positively to the neighbourhood’s evolution.

Ultimately, buying property in an undesirable area is a high-risk, high-reward strategy. It demands a higher level of research, risk management, and often, hands-on involvement from the investor. While the potential for high yields and long-term capital growth is compelling, it is balanced by genuine risks related to safety, slow appreciation, and financing. Success depends on your ability to see potential where others see problems and your willingness to actively manage the challenges involved.